Get the latest news delivered right to your email.

2024 Election

Top Stories

Advertisement

Columbia Bows to Anti-Israel Agitators, Makes Numerous Concessions as Deadline Comes and Goes

Columbia says protesters "have taken steps to make the encampment welcome to all and have prohibited discriminatory or harassing language."

By George C. Upper III

April 24, 2024

Comment

MoreShare

Hundreds of Anti-Israel Agitators Swarm Chuck Schumer's House, Police Move In and Make Mass Arrests

Demonstrators wore shirts that read “CEASEFIRE NOW” while some held signs that read, “STOP FUNDING GENOCIDE.”

By Johnathan Jones

April 24, 2024

Comment

MoreShare

USA Today Columnist Infuriated Over Caitlin Clark Shoe Deal, Says Black Players Deserve It

The columnist argued that Clark's deal "shows how Black women are being ignored in a league that they dominate.

By Anthony Altomari

April 24, 2024

Comment

MoreShare

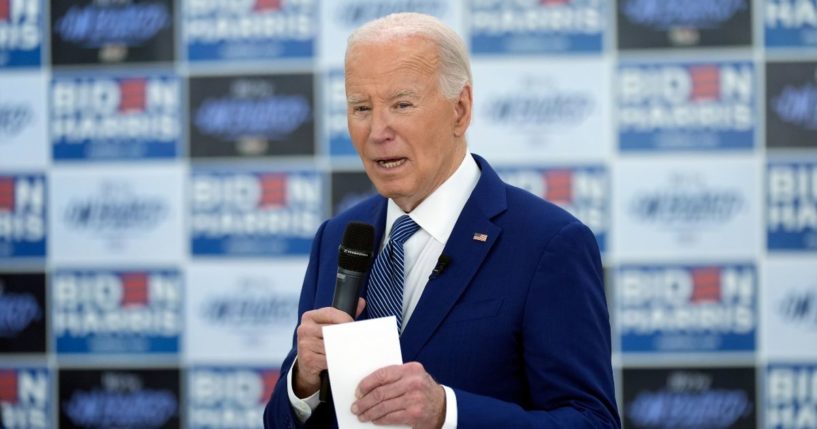

'This Is Vile': Biden Comes Under Fire for Invoking Jesus While Promoting Abortion

The Apostle Paul wrote 2,000 years ago that Christians must pray for their political leaders. This is a great example of why.

By George C. Upper III

April 24, 2024

Comment

MoreShare

Watch: Top Democrat Chuck Schumer Cheers on Mike Johnson, Thanks Him for Pushing Ukraine Aid

Speaker of the House Mike Johson is receiving praise for his support of billions in foreign aid being passed by Democrat Chuck Schumer.

By Samuel Short

April 24, 2024

Comment

MoreShare

Biden to Give Commencement Address at College, But Faculty Backlash Is Already Causing Problems: Report

Biden's attempts to play both sides of the Israel-Hamas conflict might turn his upcoming commencement address into a disaster.

By Allison Anton

April 23, 2024

Comment

MoreShare

'This Is Vile': Biden Comes Under Fire for Invoking Jesus While Promoting Abortion

The Apostle Paul wrote 2,000 years ago that Christians must pray for their political leaders. This is a great example of why.

By George C. Upper III

April 24, 2024

Comment

MoreShare

Nancy Pelosi Embarrasses US While Traveling Abroad with Extremely Foolish Attempt to Interfere with Israeli Politics

If a powerful foreign leader said the same thing about President Joe Biden, the Democrats would be up in arms.

By Allison Anton

April 23, 2024

Comment

MoreShare

Advertisement

Biden Breaking the Ten Commandments: Part Four - Bidenomics Subverts the Sabbath

Biden is upsetting the balance of rest and work ordered by God — and Americans are paying the price economically and spiritually.

Comment

MoreShare

Former Military Chaplain Talks Becoming Battle-Ready to Serve in God's End-Times Army

U.S. Army Col. (Ret.) David Giammona believes the world is entering the end times, and "the Lord wants us to work even harder."

Comment

MoreShare

Interview: Jeremy Carl Sounds the Alarm on 'How Anti-White Racism Is Tearing America Apart'

In a new book, Carl asserts that if there is anything resembling systematic racism in America today, it is directed at the white majority.

Comment

MoreShare

Advertisement