Get the latest news delivered right to your email.

2024 Election

Top Stories

Advertisement

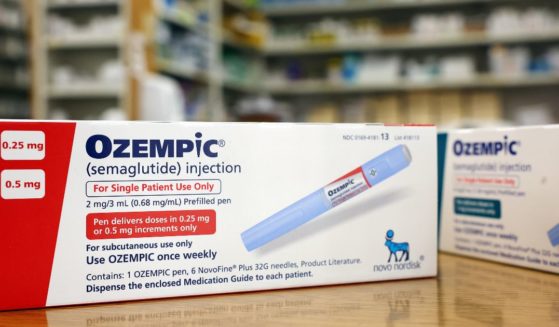

CEO Says He Can Fix Haunting Ozempic Side Effect That's Leaving Elites with Hollowed-Out Look

Galderma's CEO has proclaimed that his company has a solution to the dreaded "Ozempic face" -- but at what cost?

By Allison Anton

April 25, 2024

Comment

MoreShare

Anti-Israel Agitators at UT-Austin Learn the Hard Way That Texas Does Things Differently Than Blue States

The difference between how red states and blue states are handling these protests is night and day. It just goes to show you what works.

By Laura Wellington

April 25, 2024

Comment

MoreShare

NYC Construction Workers and Union Members Go Wild When Trump Makes Unexpected Visit En Route to Courthouse

A New York Times Siena poll released on Monday reveals that Trump is now only 10 points behind Biden in this deep blue state.

By Rachel M. Emmanuel

April 25, 2024

Comment

MoreShare

A Nuclear Apocalypse Has Never Been This Fun: After the 'Fallout' Show, Here Are the Games to Play

The Fallout franchise has featured a number of games. Here are seven of them that this author has played, and which ones you should.

By Bryan Chai

April 25, 2024

Comment

MoreShare

Biden Gets Even More Delusional, Says He Can Win Red State That He Lost

It was a strange assertion from the president in light of both history and available data, but we should not have expected otherwise.

By Michael Schwarz

April 25, 2024

Comment

MoreShare

Anti-Israel Agitators at UT-Austin Learn the Hard Way That Texas Does Things Differently Than Blue States

The difference between how red states and blue states are handling these protests is night and day. It just goes to show you what works.

By Laura Wellington

April 25, 2024

Comment

MoreShare

Report: Family Outraged at Disney World - Realized the Evil Queen 'Actress' They Took Pics with Was a Man

A father was outraged when it appeared that Walt Disney World reportedly hired a man to interact with children as the Evil Queen.

By Allison Anton

April 24, 2024

Comment

MoreShare

Interviewer's Simple Question Gets NYU Protester to Admit She Has No Idea What's Going On: 'I Wish I Was More Educated'

These protesters didn't even try to act as if they knew the reasons they were protesting NYU at all, admitting ignorance almost immediately.

By Allison Anton

April 24, 2024

Comment

MoreShare

Advertisement

'Woman': The Left's Absurd Quest to Redefine the Term

The question “What is a woman?” is perfectly leveraged to produce absurdity because to pose this question is absurd.

Comment

MoreShare

Biden Breaking the Ten Commandments: Part Four - Bidenomics Subverts the Sabbath

Biden is upsetting the balance of rest and work ordered by God — and Americans are paying the price economically and spiritually.

Comment

MoreShare

Former Military Chaplain Talks Becoming Battle-Ready to Serve in God's End-Times Army

U.S. Army Col. (Ret.) David Giammona believes the world is entering the end times, and "the Lord wants us to work even harder."

Comment

MoreShare

Advertisement