Get the latest news delivered right to your email.

2024 Election

Top Stories

Advertisement

Netflix Plans to Withhold a Key Metric from Shareholders: Is Streaming Titan Hiding Something?

"In our early days, when we had little revenue or profit, membership growth was a strong indicator of our future potential."

By Bryan Chai

April 20, 2024

Comment

MoreShare

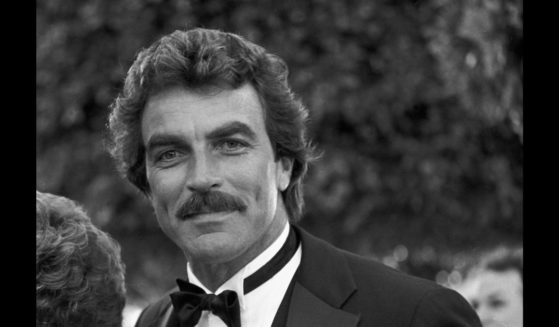

Flashback: The Time 'Magnum P.I.' Himself, Tom Selleck, Taught Rosie O'Donnell a Lesson About 2A Rights

Despite pressure from hostile interviewers like Rosie O'Donnell, Tom Selleck has always advocated for Americans' Second Amendment rights.

By Allison Anton

April 20, 2024

Comment

MoreShare

'Civil War': Hit New Film Is Propaganda for Corrupt Establishment Media 'Journalism'

The new hit film "Civil War" portrays establishment media journalism as a completely objective institution.

By Michael Austin

April 20, 2024

Comment

MoreShare

Black Americans Turning on Biden in His Own Home State: 'Donald Trump Is Who We Want'

Joe Biden's black voter base is dwindling, and it's leaving the door wide open for Donald Trump.

By Laura Wellington

April 19, 2024

Comment

MoreShare

The Next Caitlin Clark? New Star Already Getting Praise from Her as She Heads to Iowa

She is one of women's basketball's top scorers, and next year she will be playing for Iowa, after announcing her transfer there.

By Jack Davis

April 19, 2024

Comment

MoreShare

Middle School Girls Take Brave Stand at Track Meet When Adults Force Them to Compete Against Transgender Opponent

It’s tragic that the state of our crumbling society had even put these girls in a position to protest during their own sporting event.

By Johnathan Jones

April 19, 2024

Comment

MoreShare

Revealed: Growing Number of Young People Now Identify as 'Gender Season'

Gender identities have moved beyond the simple permutations of male and female, with "gender season" now entering the chat.

By Allison Anton

April 19, 2024

Comment

MoreShare

Black Americans Turning on Biden in His Own Home State: 'Donald Trump Is Who We Want'

Joe Biden's black voter base is dwindling, and it's leaving the door wide open for Donald Trump.

By Laura Wellington

April 19, 2024

Comment

MoreShare

Advertisement

The Left Is Wrong: Trans Suicides Surge Following 'Gender-Affirming' Surgeries, Study Shows

The left loves to claim that "gender-affirming care" saves lives. Here's the reality.

Comment

MoreShare

America Celebrates 249 Years of Rebellion Against Tyrants - Why We Must Remember Lexington & Concord

As Ronald Reagan said, there is nowhere left to run. We must restore our founding principles and reignite the American Dream.

Comment

MoreShare

The Left Is Wrong About Negative Human Impact on Climate

The rising level of CO2 in the atmosphere is a natural — not man-made — phenomenon, according to a top scientist.

Comment

MoreShare

Advertisement