Get the latest news delivered right to your email.

2024 Election

Top Stories

Advertisement

Heroic 8th-Grade Student Snaps Into Action When Bus Driver Passes Out Behind the Wheel

While the student was modest about his potentially life-saving actions, people who live in his community are calling him a hero.

By Johnathan Jones

April 26, 2024

Comment

MoreShare

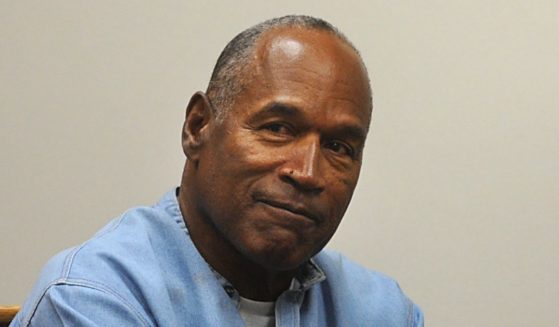

OJ Simpson's Cause of Death Confirmed as Debilitating, Painful Disease

Just weeks before his death, Simpson was said to have been in good enough shape to enjoy drinking beer on his sofa.

By Johnathan Jones

April 26, 2024

Comment

MoreShare

Megan Rapinoe Demands Trans Athletes Be Allowed to Compete Against Women - Remember When Her Team Faced Teenage Boys?

Do you remember what happened when Rapinoe and the USWNT faced the FC Dallas under-15 boys team back in 2017?

By Connor Cavanaugh

April 26, 2024

Comment

MoreShare

The New York Times Torches Biden for 'Troubling' Media Strategy in Official Statement

"It also establishes a dangerous precedent that future presidents can use to avoid scrutiny and accountability."

By Rachel M. Emmanuel

April 26, 2024

Comment

MoreShare

High School Student Who Refused to Remove US Flag from Truck Puts His Vehicle to Work, Drives Across Country for an Amazing Reason

The high school student who refused to remove the American flag from his truck used that same pickup to honor a boy's dying wish.

By Allison Anton

April 26, 2024

Comment

MoreShare

Democrats Run Focus Groups to Figure Out Why People Don't Like Kamala Harris and End Up Learning the Brutal Truth

"The bad news: Several people said Harris rubs them the wrong way, in all the ways that are familiar from criticism of her," CNN said.

By Connor Cavanaugh

April 26, 2024

Comment

MoreShare

Mitch McConnell Takes Public Shot at Tucker Carlson, Accuses Him of Turning Republicans Against Ukraine Aid

McConnell accused Carlson of turning Americans against Ukraine as the Senate prepares to vote on the most recent aid package.

By Anthony Altomari

April 26, 2024

Comment

MoreShare

Adam Schiff Forced to Give Important Speech Without a Suit After California Thieves Steal His Clothes

Instead of attending a fundraiser in his usual suit and tie, Schiff wore a long-sleeve shirt and a hiking vest after his luggage was stolen.

By Johnathan Jones

April 26, 2024

Comment

MoreShare

Advertisement

Supreme Court Set to Decide Case That Could Criminalize Homeless Encampments

The U.S. Supreme Court heard oral arguments Monday regarding a case that could have major implications regarding homelessness in America.

Comment

MoreShare

Biden, Feds Possess Secret AI Tool to Censor and Indoctrinate 'At Scale' Ahead of Election - What You Need to Know

The House Judiciary Committee says there's an AI censorship program designed to skew the narrative toward the left before the 2024 election.

Comment

MoreShare

'Woman': The Left's Absurd Quest to Redefine the Term

The question “What is a woman?” is perfectly leveraged to produce absurdity because to pose this question is absurd.

Comment

MoreShare

Advertisement