Get the latest news delivered right to your email.

2024 Election

Top Stories

Advertisement

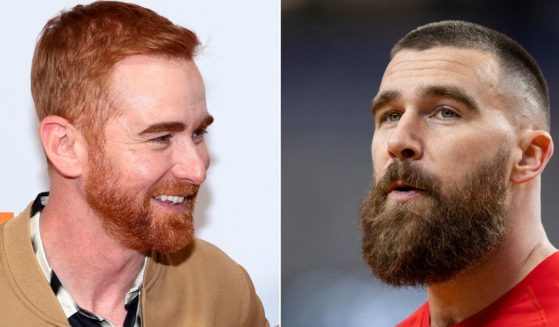

Travis Kelce Thrown Under the Bus, Gets Exposed for Flashing Comedian During Interview

Most NFL players doing something gross would be ignored, but when it is Travis Kelce, here come the jokes and headlines.

By Jack Davis

April 26, 2024

Comment

MoreShare

Watch: Georgia State Trooper Puts NFL Pros to Shame with Ruthless Tackle on Anti-Israel Protester

A trooper's perfect-form tackle of a campus protester should remind us not to take those leftist narcissists too seriously.

By Michael Schwarz

April 26, 2024

Comment

MoreShare

Trump Stunned by 'Amazing Testimony' During Hush Money Trial, Says It Was 'Breathtaking'

Former President Donald Trump emerged from a day of testimony in his hush money trial to call the day "breathtaking."

By Jack Davis

April 26, 2024

Comment

MoreShare

Another Grocery Staple Surging to Record High - The Days of Cheap Breakfasts Are Gone

Joe Biden has caused the price of all our daily needs to skyrocket. And here is just another example of how he has burdened America.

By Warner Todd Huston

April 26, 2024

Comment

MoreShare

Billionaire's Teen Daughter Missing: Frightening Theory Put Forward by Police

While not believed abducted, the missing 16-year-old's background presents other fears, especially regarding where she may have gone.

By Mike Landry

April 26, 2024

Comment

MoreShare

Democrats Run Focus Groups to Figure Out Why People Don't Like Kamala Harris and End Up Learning the Brutal Truth

"The bad news: Several people said Harris rubs them the wrong way, in all the ways that are familiar from criticism of her," CNN said.

By Connor Cavanaugh

April 26, 2024

Comment

MoreShare

Watch: Georgia State Trooper Puts NFL Pros to Shame with Ruthless Tackle on Anti-Israel Protester

A trooper's perfect-form tackle of a campus protester should remind us not to take those leftist narcissists too seriously.

By Michael Schwarz

April 26, 2024

Comment

MoreShare

Mitch McConnell Takes Public Shot at Tucker Carlson, Accuses Him of Turning Republicans Against Ukraine Aid

McConnell accused Carlson of turning Americans against Ukraine as the Senate prepares to vote on the most recent aid package.

By Anthony Altomari

April 26, 2024

Comment

MoreShare

Advertisement

Supreme Court Set to Decide Case That Could Criminalize Homeless Encampments

The U.S. Supreme Court heard oral arguments Monday regarding a case that could have major implications regarding homelessness in America.

Comment

MoreShare

Biden, Feds Possess Secret AI Tool to Censor and Indoctrinate 'At Scale' Ahead of Election - What You Need to Know

The House Judiciary Committee says there's an AI censorship program designed to skew the narrative toward the left before the 2024 election.

Comment

MoreShare

'Woman': The Left's Absurd Quest to Redefine the Term

The question “What is a woman?” is perfectly leveraged to produce absurdity because to pose this question is absurd.

Comment

MoreShare

Advertisement