Get the latest news delivered right to your email.

2024 Election

Top Stories

Advertisement

Eat Garlic for Your Health

The garlic herb may be small and stinky, but the potential role it can play in one's overall health is enormous.

By Michigan State University Extension

April 23, 2024

Comment

MoreShare

Outmatched or Outsourced? Why Parents' Values Fail to Translate to Their Children

A recent poll reveals why daughters are more susceptible to deviating from their conservative parents' political viewpoint.

By Washington Stand

April 23, 2024

Comment

MoreShare

Must Watch: Argentina's President Promotes US Founding Principles, Highlights Way to Prosperity

"Politicians want to spend a lot because they are the main beneficiaries of that spending. That is over with us."

By Rachel M. Emmanuel

April 23, 2024

Comment

MoreShare

Watch: Trump Backs Senate Candidate He Once Said Was 'Not MAGA' in Key Swing State

Former President Donald Trump is now endorsing a Republican candidate for the Senate who he did not support in 2022.

By Jack Davis

April 23, 2024

Comment

MoreShare

New Dad Goggles: How Fatherhood Changed the Way I Experienced 'Red Dead Redemption'

Few stories in video games have had the cultural heft or impact that 2010 masterpiece "Red Dead Redemption" has had.

By Bryan Chai

April 23, 2024

Comment

MoreShare

Biden to Give Commencement Address at College, But Faculty Backlash Is Already Causing Problems: Report

Biden's attempts to play both sides of the Israel-Hamas conflict might turn his upcoming commencement address into a disaster.

By Allison Anton

April 23, 2024

Comment

MoreShare

Nancy Pelosi Embarrasses US While Traveling Abroad with Extremely Foolish Attempt to Interfere with Israeli Politics

If a powerful foreign leader said the same thing about President Joe Biden, the Democrats would be up in arms.

By Allison Anton

April 23, 2024

Comment

MoreShare

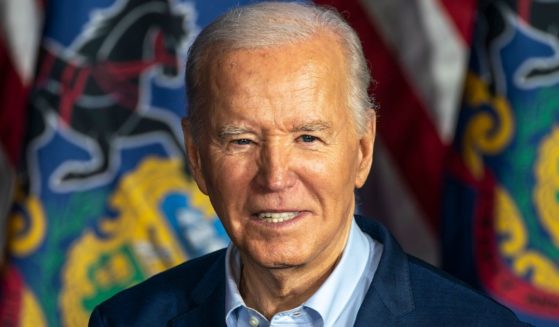

Watch: Biden Just Had a 'Very Fine People on Both Sides' Moment That Could Cause Him Big Trouble

The vipers in the establishment media have given Biden a pass for the same transgression of which they once falsely accused Trump.

By Michael Schwarz

April 23, 2024

Comment

MoreShare

Advertisement

Biden Breaking the Ten Commandments: Part Four - Bidenomics Subverts the Sabbath

Biden is upsetting the balance of rest and work ordered by God — and Americans are paying the price economically and spiritually.

Comment

MoreShare

Former Military Chaplain Talks Becoming Battle-Ready to Serve in God's End-Times Army

U.S. Army Col. (Ret.) David Giammona believes the world is entering the end times, and "the Lord wants us to work even harder."

Comment

MoreShare

Interview: Jeremy Carl Sounds the Alarm on 'How Anti-White Racism Is Tearing America Apart'

In a new book, Carl asserts that if there is anything resembling systematic racism in America today, it is directed at the white majority.

Comment

MoreShare

Advertisement