Get the latest news delivered right to your email.

2024 Election

Top Stories

Advertisement

Hollywood Is Reportedly in Rough Shape and in the Midst of Massive Change: 'Money Is So Tight'

"But we’re seeing things go out that don’t get any buyers, which is unusual. That hasn’t happened in a while."

By Bryan Chai

April 25, 2024

Comment

MoreShare

Biden, Feds Possess Secret AI Tool to Censor and Indoctrinate 'At Scale' Ahead of Election - What You Need to Know

The House Judiciary Committee says there's an AI censorship program designed to skew the narrative toward the left before the 2024 election.

By Laura Wellington

April 25, 2024

Comment

MoreShare

Biden Calls for Record-High Taxes ... We're Closing in on a 50% Rate

Biden's proposed tax increase called forth a debate from another era and reminded us that our Founders would not tolerate this government.

By Michael Schwarz

April 25, 2024

Comment

MoreShare

Southwest Airlines Cuts 2,000 Workers, Loses Over $200M as Labor Costs Soar

Southwest CEO Bob Jordan said Boeing’s ongoing production and safety issues were partly to blame for the airline's rough quarter.

By Johnathan Jones

April 25, 2024

Comment

MoreShare

Bidenomics: Inflation Killing The American Dream - $100k No Longer Enough To Survive in These States

"It becomes increasingly hard for many families to be able to attain that sort of middle-class lifestyle, that American Dream."

By George C. Upper III

April 25, 2024

Comment

MoreShare

Report: Family Outraged at Disney World - Realized the Evil Queen 'Actress' They Took Pics with Was a Man

A father was outraged when it appeared that Walt Disney World reportedly hired a man to interact with children as the Evil Queen.

By Allison Anton

April 24, 2024

Comment

MoreShare

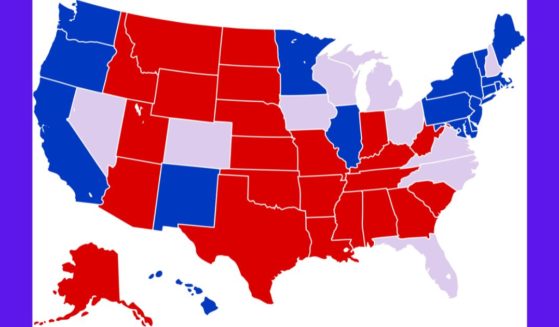

Anti-Israel Agitators at UT-Austin Learn the Hard Way That Texas Does Things Differently Than Blue States

The difference between how red states and blue states are handling these protests is night and day. It just goes to show you what works.

By Laura Wellington

April 25, 2024

Comment

MoreShare

Interviewer's Simple Question Gets NYU Protester to Admit She Has No Idea What's Going On: 'I Wish I Was More Educated'

These protesters didn't even try to act as if they knew the reasons they were protesting NYU at all, admitting ignorance almost immediately.

By Allison Anton

April 24, 2024

Comment

MoreShare

Advertisement

Biden, Feds Possess Secret AI Tool to Censor and Indoctrinate 'At Scale' Ahead of Election - What You Need to Know

The House Judiciary Committee says there's an AI censorship program designed to skew the narrative toward the left before the 2024 election.

Comment

MoreShare

'Woman': The Left's Absurd Quest to Redefine the Term

The question “What is a woman?” is perfectly leveraged to produce absurdity because to pose this question is absurd.

Comment

MoreShare

Biden Breaking the Ten Commandments: Part Four - Bidenomics Subverts the Sabbath

Biden is upsetting the balance of rest and work ordered by God — and Americans are paying the price economically and spiritually.

Comment

MoreShare

Advertisement