Get the latest news delivered right to your email.

2024 Election

Top Stories

Advertisement

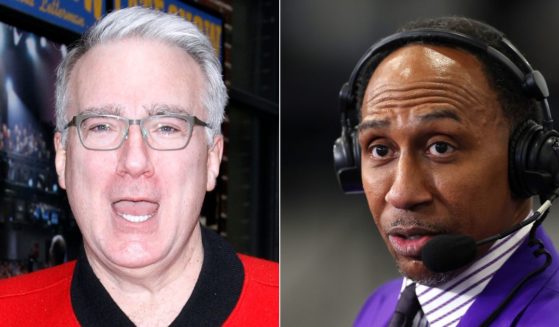

Keith Olbermann Issues Ultimatum to ESPN: Silence or Fire Stephen A. Smith After Trump Comments

Smith has faced considerable backlash for saying that Donald Trump "wasn't lying" when he said black Americans find him relatable.

By Anthony Altomari

April 24, 2024

Comment

MoreShare

Mother Credits Son's Classmates for Saving His Life from 'Transgender' Sex Offender

The mom of a child who was almost grabbed by a sex offender while at recess is livid with the way the school responded to the incident.

By Jack Davis

April 24, 2024

Comment

MoreShare

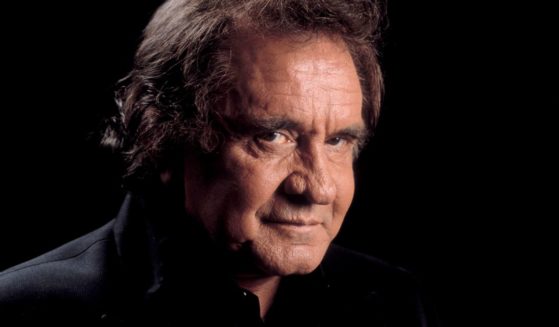

'Completely Freak Accident' on Set of Upcoming Eddie Murphy Movie Injures, Hospitalizes Multiple Crew Members

"The well-being of the entire crew and cast is our first priority, and we will continue to insist on the highest industry standards."

By George C. Upper III

April 24, 2024

Comment

MoreShare

Watch: Jason Whitlock Under Fire for Racial Comments About 'White Girl' Caitlin Clark

Those who criticized Whitlock for merely mentioning skin color should redirect their outrage toward more appropriate and insidious targets.

By Michael Schwarz

April 24, 2024

Comment

MoreShare

Massive Upgrade: Chick-fil-A Set to Take Over and Demolish a Seedy Strip Club to Make Way for a New Restaurant

Since 1984, the address for a proposed Chick-fil-A in Portland has been the home of a strip club called The Venue Gentlemen’s Club.

By Johnathan Jones

April 24, 2024

Comment

MoreShare

Nancy Pelosi Embarrasses US While Traveling Abroad with Extremely Foolish Attempt to Interfere with Israeli Politics

If a powerful foreign leader said the same thing about President Joe Biden, the Democrats would be up in arms.

By Allison Anton

April 23, 2024

Comment

MoreShare

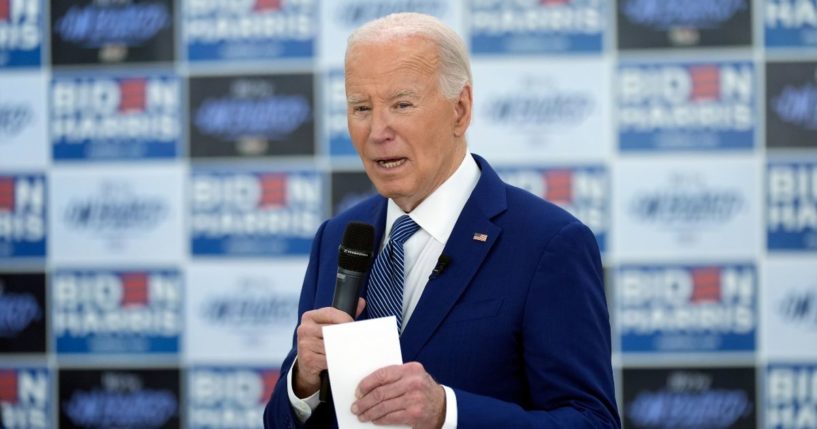

'This Is Vile': Biden Comes Under Fire for Invoking Jesus While Promoting Abortion

The Apostle Paul wrote 2,000 years ago that Christians must pray for their political leaders. This is a great example of why.

By George C. Upper III

April 24, 2024

Comment

MoreShare

Watch: Biden Admits 'We Can't Be Trusted' in Latest Major Blunder

Watch the clip with YouTube's closed captioning on, and you'll see that even its talk-to-text AI recognized what Biden said here.

By George C. Upper III

April 24, 2024

Comment

MoreShare

Advertisement

Biden Breaking the Ten Commandments: Part Four - Bidenomics Subverts the Sabbath

Biden is upsetting the balance of rest and work ordered by God — and Americans are paying the price economically and spiritually.

Comment

MoreShare

Former Military Chaplain Talks Becoming Battle-Ready to Serve in God's End-Times Army

U.S. Army Col. (Ret.) David Giammona believes the world is entering the end times, and "the Lord wants us to work even harder."

Comment

MoreShare

Interview: Jeremy Carl Sounds the Alarm on 'How Anti-White Racism Is Tearing America Apart'

In a new book, Carl asserts that if there is anything resembling systematic racism in America today, it is directed at the white majority.

Comment

MoreShare

Advertisement